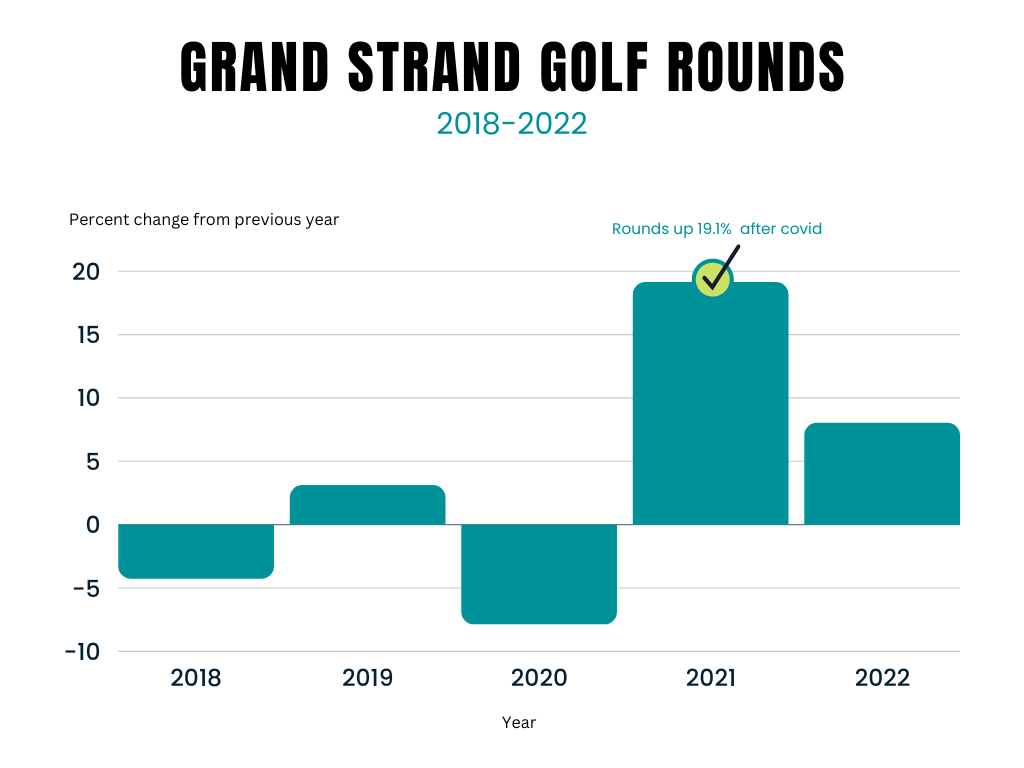

The coronavirus pandemic continues to be a boon for Myrtle Beach golf.

The onset of Covid-19 in 2020 led more people to the game, and the spike in interest has been reflected in the best two years for rounds played on the Grand Strand in more than a decade.

Rounds increased 8 percent in 2022 compared to 2021, and revenue derived solely from green and cart fees increased 13 percent year-over-year, according to the Myrtle Beach Area Golf Course Owners Association.

Going back a few years, rounds in 2022 were up 23 percent compared to 2018 and revenue increased 35 percent. Comparing 2022 to 2019, rounds were up 20 percent and revenue increased 31 percent.

The basis for the data is the 59 courses that were members of the Golf Tourism Solutions marketing and technology agency for the entirety of the past two years, as they use the same tee time network. GTS promotes the market, which has more than 70 public courses stretching from Georgetown, S.C. to Bolivia, N.C.

“It’s awful to say, but Covid has been the best thing for the golf industry, not just here in Myrtle Beach,” said Tracy Conner, executive director of the MBAGCOA and GTS’ director of technology services. “Certainly it introduced new people to the game of golf, and the people that played on occasion fell back in love with the game.

“Then you overlay that with lifestyle. You have folks working from home and being more flexible with their business hours, and it has been unbelievable.”

Analyzing local data

Rounds on the 59 Strand courses increased to 2.4 million and revenue increased to $111 million in 2022, Conner said.

Absent from GTS’ total rounds last year are the five Legends Group courses – Heathland, Parkland and Moorland at Legends Resort as well as Oyster Bay and Heritage Club – which play as many rounds annually as anyone in the market with a robust membership plan. They were not members of GTS, but Conner said he expects them to return in 2023, so the rounds report might be even more impressive with their multitude of rounds factored in.

Numbers from 2020 aren’t comparable because of the impact of the pandemic, which heavily curtailed golf travel, particularly during the lucrative spring golf season.

Rounds were down 7.8 percent and revenue was down 20 percent in 2020 compared to 2019, according to the MBAGCOA, as local golfers replaced traveling golfers in many instances and paid lower rates. The governors in both Carolinas states never closed courses, allowing constituents to have an outdoor activity.

“You just need to take 2020 and set it aside [regarding comparisons],” Conner said.

The Strand’s most affordable courses enjoyed the largest increases in 2022, Conner said. The courses in the lowest of the MBAGCOA’s four tiers of courses based on rates saw rounds increase 16 percent and revenue improve 27 percent. Each of the four tiers were up in rounds and revenue as a group.

“2022 continued the momentum we built in 2021,” said Steve Mays, president of Founders Group International, which owns and operates 21 Strand courses. “Our package play was good, our local play was good and our member play was good – kind of all around. So demand for golf remained strong in 2022.”

Good weather always helps boost the numbers, and aside from a couple outliers, including Hurricane Ian in late September, the weather was generally good in 2022.

The early numbers for Myrtle Beach golf in 2023 are promising.

As of New Year’s Day, there were 17 percent more rounds booked on tee sheets for the coming year than there were for 2022 last Jan. 1, Conner said.

“At this point 2023 continues to look strong moving forward so we’re happy where we are there,” Mays said. “The demand for Myrtle Beach and demand for the destination remain strong. As well as all the people moving into our area who are playing golf and becoming members at our golf courses with our loyalty program.”

A model golf destination

Myrtle Beach’s numbers in 2022 far exceeded national averages.

According to Golf Datatech, which provides national rounds played statistics to the National Golf Foundation, rounds through November were down 2.8 percent nationally in 2022 compared to 2021, including down 2.4 percent in the South Atlantic region that includes the Carolinas.

That followed year-over-year increases of 14 percent in 2020 – despite the loss of an estimated 20 million rounds in the spring of 2020 when Covid restrictions peaked – and 5.5 percent in 2021, according to the NGF.

The NGF said search popularity for golf on the internet reached its highest point in 13 years in the U.S. in 2022.

And Myrtle Beach led the way.

After the coronavirus surged in internet searches in 2020-21, golf finally regained the lead in search share vs. “Covid” in certain U.S. markets in 2022, with the Florence-Myrtle Beach area leading with a 58% share. It was followed by Sioux City, Iowa (55%), Ft. Myers-Naples, Florida (54%), Panama City, Florida (53%) and Palm Springs, California (51%).

Myrtle Beach’s rising popularity for people both traveling and relocating is reflected in traffic at the Myrtle Beach International Airport, which set a record for total passengers in 2022 with nearly 3.3 million enplanements and deplanements with December yet to be accounted for.

That breaks the record of 3,210,247 total passengers set in 2021, according to the airport.

A $100 million expansion and improvement of the airport is planned over the next three years to service anticipated new record traffic.

Golf’s Covid resurgence has come following two decades of declines or stagnation in rounds played both nationally and locally, and makes the decision to put money back into golf courses easier to make.

FGI closed both the Grande Dunes Resort Course and River Hills Golf & Country Club for at least two months last summer for renovation projects, and will be considering improvements to other courses in 2023 and beyond.

“When the demand for the product is high, it does make those decisions a little bit easier to make when you’re trying to make those renovations,” Mays said. “Across the country the golf industry has been tough over the past 15 to 20 years, so there hasn’t been a lot of investments in properties.

“So now that the demand is strong and revenue is in a good place you want to take advantage of those opportunities and better your product. From a golf destination perspective we want to make sure we’re continuing to better our product.”

Mays said he and others in the market are aware of economist projections of a possible recession in the U.S. in the midst of high inflation, high interest rates and high fuel prices, so they are inclined to temper their optimism for golf in 2023.

“But we don’t see it in our number right now,” Mays said. “Not that we won’t slow down, but we haven’t seen that in our numbers yet.”